“My mom dreamt of operating a series of shops. This was within the eighties, when entry to capital was scarce, and operating solely a single retailer was potential. I do assume that at a special time, in a special place, she might have constructed a a lot bigger franchise,” says Hardika Shah, the founder and CEO of Kinara Capital.

This thought remained in Hardika’s thoughts all through her 20s and 30s as she navigated life and located her footing as a administration guide in Silicon Valley. Rising up in Mumbai in a center class household, her life and upbringing was removed from strange.

Whereas her mom owned a small enterprise, her father, who’s blind, taught at a ladies’s faculty. They challenged societal conditioning and conventional roles, and battled in opposition to all odds to provide their two women all the pieces they wanted to fulfil their desires — even when that concerned promoting their suburban Mumbai house and shifting to a smaller house to fund Hardika’s undergraduate training within the US.

Apart from supporting his personal daughters, Hardika’s father additionally offered financial assist to blind faculties by sponsoring braille printers. The idea of giving again and its social influence was drilled into her. As an grownup, when she discovered about social entrepreneurship as an grownup, she discovered the lacking puzzle piece.

Then after 23 years of being within the US, she returned to India in 2011 to launch Kinara Capital. It offers unsecured loans to Micro, Small and Medium-sized Enterprises (MSMEs) inside 24-48 hours and has helped over 1,25,000 enterprise homeowners to date. Her imaginative and prescient was to supply capital to small enterprise homeowners so that everybody might increase their ventures.

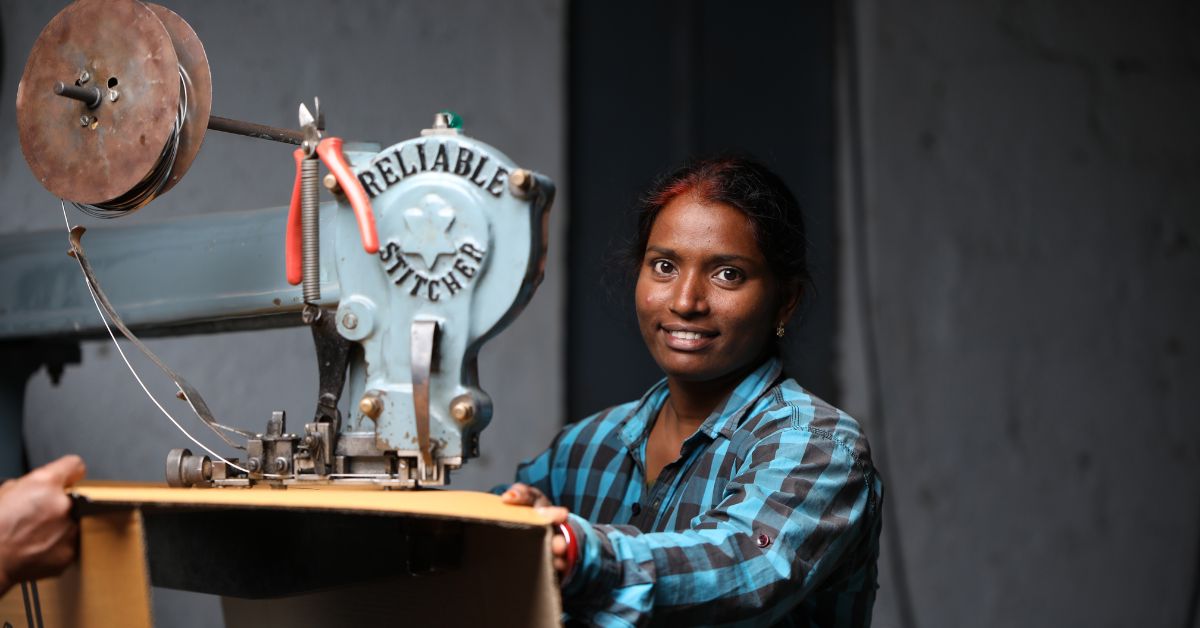

Her enterprise has a particular give attention to ladies, be it of their private workforce, the place nearly 60 % prime administration are ladies, or by their ‘HerVikas’ programme, that gives discounted enterprise loans for women-owned MSMEs to assist them take their companies to the following stage.

Right here’s how Hardika constructed this enterprise which has disbursed over Rs 6,760 crores to date.

Seeds of social entrepreneurship

After coming into junior faculty, Hardika wasn’t too comfortable about the truth that she might solely select one topic to main in. She was inquisitive about a number of topics, and wished for a course that will enable her that liberty.

Throughout the identical time, her father who taught political science, would frequent the American library in Mumbai. He used to take his daughters there once in a while. Right here, Hardika got here throughout the programs taught in American faculties.

“I found liberal arts, the place you possibly can examine a variety of topics and nonetheless get a graduate diploma. It was simply what I needed and after I learnt about it, it turned my purpose to pursue this course within the US,” Hardika tells The Higher India.

Hardika’s upbringing was non-traditional in plenty of methods. Her mom had been ostracised by her household for her alternative of accomplice and confronted many struggles, but the household selected to be comfortable and stay a life full of affection, happiness and desires.

Along with her unconventional upbringing, her mother and father allowed her and her sister to dream huge, work throughout junior faculty, have totally different life experiences and most significantly, go overseas for an undergraduate diploma, which was fairly remarkable then.

Hardika labored summers after ending Class 10, the place her first job was working as a market researcher for shampoo fragrances. After that, she labored as a font designer.

“Simply earlier than going to school, I needed to create fonts for Indian languages on the pc. Since they needed somebody who might deal with computer systems and had a creative thoughts, I acquired the job and labored there for 3 months,” provides the Bengaluru resident.

Whereas she managed her pocket cash, elevating funds for her undergraduate diploma within the US was no imply feat. Hardika shares that she spent nearly 18 months getting ready for all of the totally different exams, however principally simply looking for avenues for her funds.

“It was actually not low cost to go to the US within the 80s. Liberal arts faculties then gave some monetary assist, but it surely was very restricted,” she provides.

Her mother and father got here to her rescue and offered their home to fund her training, shifting to a smaller rented house.

The then teenager entered Knox Faculty in Illinois, USA, the place she pursued a BA in pc science. The diploma gave her the chance to check all the pieces from world historical past, anthropology, economics to symbolic logic other than conventional topics.

After her undergraduate diploma, she labored at Accenture in Chicago, Singapore, Sydney, after which again once more within the US in San Francisco in monetary providers, expertise and consulting for nearly 19 years.

Her work additionally introduced her to India nearly 10 years later, within the put up liberalisation period. For somebody working within the Silicon Valley, she discovered a stark distinction and a giant hole in accessibility that wanted to be crammed.

She then determined to spend her weekends each summer time as a social influence enterprise mentor.

“I might spend time with entrepreneurs internationally, together with India, and assist them develop their enterprise concepts, fashions and likewise face associated challenges,” she provides.

She adopted this mentorship up with an government MBA on the College of California, Berkeley, Haas Faculty of Enterprise. She observed a sample within the challenges confronted by folks in India, and one recurring problem emerged — entry to capital.

Discovering the lacking piece of the puzzle

“I spent three months in India with bankers, techies, and self-help teams to grasp the place the hole in entry to capital lay earlier than beginning Kinara. In spite of everything, micro finance and Non-Banking Monetary Firms (NBFCs) had expanded very properly within the nation by then, and have been in a position to meet the wants of individuals in rural India,” provides Hardika.

The main credit score hole, the guide discovered, was within the ‘lacking center’, of individuals in want of loans within the vary of Rs 1 lakh to Rs 10 lakh.

Assembly these small enterprise homeowners, SHGs, ladies entrepreneurs, led to a deja vu second.

Didn’t her mom face the identical downside 25 years again? Why was nobody in a position to repair this credit score hole for this revenue group, questioned Hardika.

Decided to make sure that nobody ought to have unfulfilled desires because of lack of capital like her mom, the 53-year-old determined to resolve the issue. Offering collateral was a significant downside on this bracket, which she solved by Kinara Capital by offering unsecured loans.

“The largest hole throughout tier 1, 2 and three cities was unsecured enterprise lending, as many of the debtors don’t have land or property to supply as collateral. I made a decision to give attention to folks in these cities who’re on the perimeter of inclusion,” she provides.

What units Kinara Capital aside?

With Kinara Capital’s launch in 2011, Hardika raised funds from social influence funding funds like Michael & Susan Dell Basis, Patamar Capital, Gaja Capital, British Worldwide Funding (BII) and extra.

Kinara vets its prospects with the assistance of AI and Machine studying, with the final mile supply achieved by its officers. They’ve 133 branches throughout 100 cities within the nation, and have disbursed over 1,25,000 loans to date, with property underneath administration of over Rs 3,170 crores.

The rates of interest vary from 20 to 32 % on a decreasing stability foundation, with the common tenure starting from 36 to 38 months.

“Our underwriting is 95 % digital and 5 % bodily, by our gross sales officers on floor. It’s a blended tech mannequin with a bodily department community the place many of the underwriting and collections are achieved on-line,” provides the social entrepreneur.

She says that 20 % of their month-to-month disbursements go to current prospects, serving to them develop their companies.

Considered one of Kinara’s shoppers, Divya explains how the corporate’s coverage helped her.

She runs an organization referred to as Brookwoods Applied sciences in Bengaluru, and needed to take a mortgage for her enterprise. Since her enterprise was lower than a 12 months previous, most lenders refused.

“Most NBFCs and banks lend after a enterprise completes three years of operations. Kinara didn’t have such situations and gave us a mortgage, which helped us immensely. Your complete course of was streamlined and on-line. An officer from their workforce got here for inspection and sanctioned the mortgage in a short time,” she says.

Divya has been in a position to develop her firm to a turnover of Rs 3 crores in 3 years.

By way of all this, Hardika states that Kinara is worthwhile at this time and rearing to succeed in extra enterprise homeowners.

The explanation for Kinara’s existence started because of a lady entrepreneur, and therefore it’s a no brainer that their HerVikas programme, which gives reductions to ladies entrepreneurs to spice up their companies, stays profitable.

The programme has disbursed Rs 700 crores previously 5 years, providing a 1 % curiosity low cost, 60 day reimbursement vacation, 50 discount in processing charges.

With a 3.5 % to 4 % Non-Performing Asset (NPA) price, Hardika needs to succeed in extra MSMEs within the coming years, hoping to succeed in 2 lakh further prospects within the subsequent 3 years.

“There’s a notion that unsecured enterprise lending is dangerous and prospects will disappear together with your cash. Our numbers show that that is so far-off from the reality. Clients are grateful to have entry to capital and repay on time. In addition they use the cash judiciously to develop their companies,” she says.

Going ahead, she hopes to boost extra jobs by reaching extra small companies. She doesn’t need any enterprise proprietor with potential to lose out due to lack of entry to capital.

“My mom might have been a giant franchise proprietor had Kinara been current then. Let no different entrepreneur lose out on their potential because of lack of entry to capital. Let there be no regrets, ifs and buts,” says Hardika.

Edited by Padmashree Pande, Photos Courtesy Kinara Capital